Many low-income countries still lack the resources and capacity to provide universal basic governmental education of quality. The funding gap needed to provide basic education for all children, youth, and adults has increased to US$ 26 billion.

Education impact investing could mobilize new funding, enable private sector engagement in both public and private education service delivery, and introduce approaches or tools to improve efficiency in the service delivery, promote innovation in teaching and learning methods, and monitor outcomes and systemic effectiveness.

Impact investing in education remains nascent but could deliver immediate financial returns while reaching the most vulnerable beneficiaries.

Investors look at the risk and return of an investment as well as the positive and social impact it may generate. Because of the perceived lack of innovation in education, private capital can fill a gap through funding direct service provision and spur innovations that increase equitable access, enhance quality, and ensure retention.

Impact capital differs from commercial private capital in that it seeks to reach the most vulnerable beneficiaries and differs from private philanthropic capital in that it seeks to apply market-based innovations to ensure financial sustainability, if not financial profit.

The challenge for impact investors is to catalyze models and approaches that target high impact and financial sustainability simultaneously.

Invest in Education: Recommendations

Investing in Education is a question of mindset. That’s because the decision to invest in this field has a far-reaching impact: on the environment, the economy and society. Investing in Education is investing in tomorrow with a proven commitment to a better world.

Maintain realistic expectations – finding high impact and high financial returns in the short-term remains a challenge

Establish philosophical clarity upfront – funders need to be clear upfront about their priorities and timeline, taking into consideration the positive social and environmental impacts.

Look to interventions in the broader educational ecosystem – from low-cost tablets that revolutionize the textbook industry to back-office management systems to reduce teacher absenteeism.

Consider channeling capital through funds and intermediaries to deploy larger amounts more efficiently – dedicated education intermediaries with proven models that enable investors to overcome fragmentation, diversify risk and invest larger sums.

Adopt a more flexible definition of success – support a model that raises the bar for quality education, pushing the public sector to meet that bar.

Focus on innovation – seek innovation through collaborative processes.

Measure and evaluate impact on education quality and access – request evidence of model effectiveness.

Impact investing has emerged in recent years as a potentially promising tool to mobilize additional capital toward the goal of broadening access to quality education.

Impact investing includes a range of funding activities in various sectors that combine financial return with social and environmental good.

Impact capital can help to:

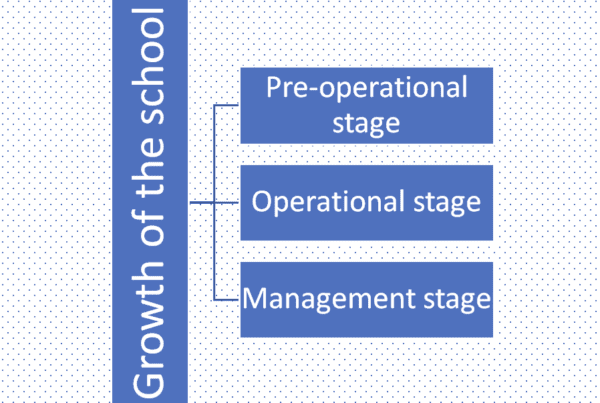

Experiment – “Prove the Concept”

Catalyze – “Grow and Refine”

Scale – “Deploy large-scale Capital “

Models that target higher-income populations with greater spending power present more investment opportunities and can offer attractive or even commercially competitive returns.

An article by Eric Debétaz